You need to sell your Lakeland, Florida house fast. Luckily you receive an acceptable offer, agree on a closing date, and pack your furniture for an eventual move. Then weeks into a real estate transaction, you receive a call from your attorney or real estate agent to inform you that the closing will be delayed.

You are left hanging, not knowing what to do. Should you continue with the real estate sale or terminate the current deal and look for a new buyer? The wait, from the time you sign a sales contract until the closing can be one of the most frustrating aspects of selling a home.

Before accepting any offer, make sure you know of the most common issues that may delay your Lakeland closing. This knowledge will help you avoid, or at the least help you decide how to react to real estate closing delays.

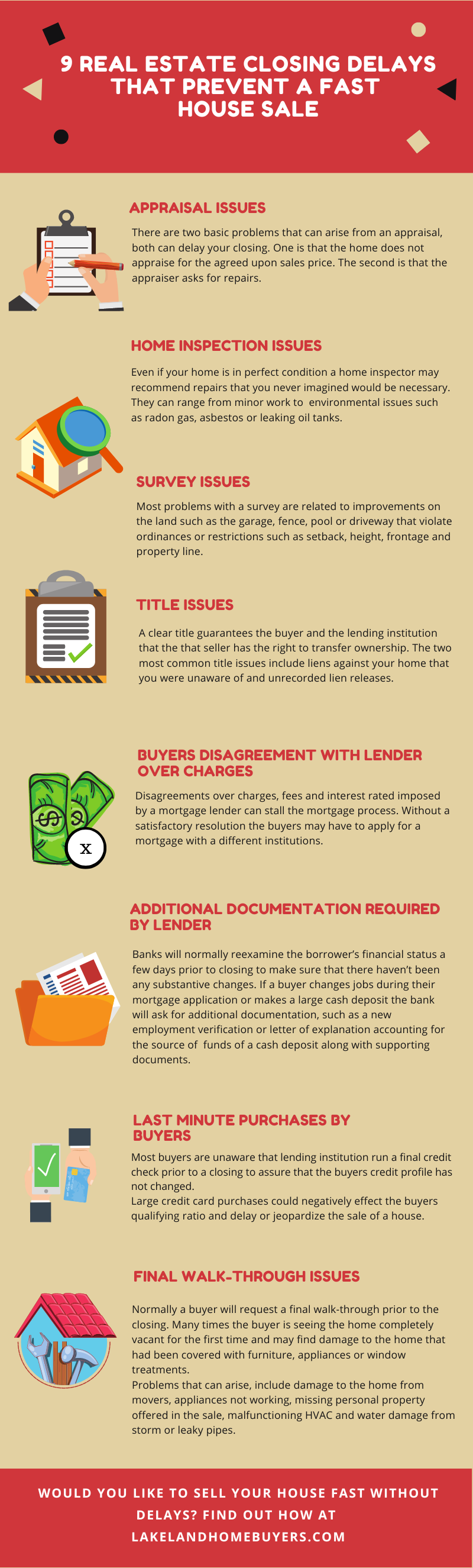

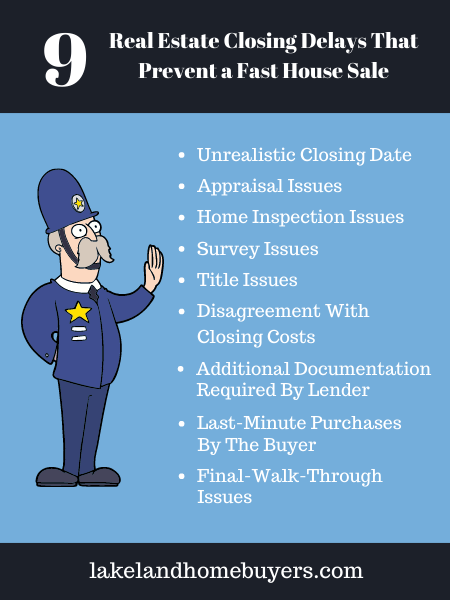

Unrealistic Closing Date

When a buyer sees you want to sell your house quickly, he may agree to a fast closing date, even if it is overly optimistic. The problem arises later when your buyer cannot close on the property on time and asks for extensions. Any delay in a closing will add to the stress of selling your home and may force you to incur added costs.

Appraisal Issues

There are two basic problems that can arise from an appraisal inspection, both can delay your closing. One is that the home does not appraise for the agreed upon sales price. If the home does not appraise your real estate agent could submit comparable home sales to the appraiser for him to reconsider his appraised value.

An unlikely second alternative is that the buyer will continue the purchase on the agreed upon sales price and make up the difference between the appraised value and the sales price with cash at closing.

Most likely however, you will have to lower your sales price to match the appraised value.

For helpful tips on what to do when you have appraisal issues read, What to Do if Your House Fails an Appraisal Inspection.

The second is that the appraiser asks for repairs. In this case, you will have to make all the required repairs to get a cleared appraisal. Without a cleared appraisal, you will not be able to close on your home.

Home Inspection Issues

Even if your Lakeland home is in a perfect condition, a home inspection may uncover repair issues. They can range from minor repairs to major structural repairs, such as a leaky roof or problems with the home’s foundation. A home inspection report may even expose environmental issues such as problems with radon gas in the home, asbestos or leaking oil tanks.

As a home seller, you have several options. You can refuse to make any of the repairs which may cause the sale to fall apart, you can make the repairs yourself or you could lower the sales price of the home to cover the cost of the repairs or remediation.

Survey Issues

Most lending institutions will require the borrower to provide them with an up-to-date survey of the property. This assures them that any improvements on the land such as the home, garage, pool or driveway do not violate any ordinances or restrictions such as setbacks, height restriction, frontage and property line.

The most common problem is that either you have intruded on your neighbor’s yard when building a fence or your neighbor has trespassed on your property. Even these minor issues could set back a closing for weeks until a resolution is reached and either the fence is removed or an affidavit of consent is signed by you and your neighbor and accepted by the buyer.

Title Issues

Another requirement for a buyer to get a mortgage approval is to order a title search on the property. This guarantees the buyer and the lending institution that the title is clear from any claims, liens, errors or restrictions and that the seller has the right to transfer ownership.

The two most common title issues include current liens against a home and unrecorded lien releases. Even if you are sure you have no liens against your home such as credit card liens, bankruptcies, tax liens or child support judgments, a title search could reveal an unrecorded lien release.

You may have paid off your home 20 or 30 years ago, but the bank may have never gotten around to record a satisfaction of mortgage in local county records office. It can take a long time to get a mortgage release, especially if your bank has closed or merged with another bank.

Buyers Disagree With Lender About Fees

Federal law requires all lenders (with minor exceptions) to give borrowers a Closing Disclosure Form three days before any mortgage loan closing. This five-page document outlines the terms and costs of your mortgage. It includes details on your loan type and length, interest rate, estimated taxes and insurance, projected monthly payments, cash to close amount and closing costs.

There can be some serious delays when the buyer disagrees with the Closing Disclosure. Disagreements arise when there are noticeable differences between the Closing Disclosure and the Good Faith Estimate. The Good Faith Estimate is a document given to the buyers at the time of a loan application. It outlines the fees the borrower should expect to pay.

For example, a difference between the interest rate offered at the loan application and the interest rate quoted in the Closing Disclosure could lead the buyer to refuse the mortgage loan. In this case, the buyer would have to apply with a different lender to get a new mortgage approval.

Additional Documentation Required By Lender

Even if your buyer has been pre-approved for a mortgage and follows through on the paperwork required to close, there can still be delays.

Banks will normally re-check the borrower’s financial status a few days before closing to make sure that there haven’t been any substantive changes. If a buyer changes jobs during their mortgage application or makes a large cash deposit (gifts from mom and dad to be spent on their new home) the bank will ask for additional documentation. They could ask for new employment verification, letter of explanation of proceeds of the cash deposit along with backup proof.

Any additional documentation must then be submitted to the loan underwriter for their review and approval before a closing can be rescheduled.

Last-Minute Purchases By The Buyers

In the excitement of owning a new home, some buyers will make last-minute purchases of furniture or appliances. Unfortunately, if the new purchases are bought on credit, it could negatively affect their qualifying ratio.

Even if the new purchases are made with cash, buyers may find themselves short of funds for the closing. In either case, the closing can be delayed until the debt is paid down or the cash saved to proceed with the closing.

Final-Walk-Through Issues

There is nothing more frustrating than to have packed and moved out of your house only to have the closing delayed or even worse to have a deal fall apart at the closing table because of final walk-through issues.

Normally a buyer will request a final walk-through of the property the day before or the day of the closing. Many times the buyer is seeing the home vacant for the first time and may find damage to the home that had been covered with furniture, appliances or window treatments. Other problems that can arise are damage to the home from the movers, including appliances not working, personal property included in the sale are missing, water damage from a storm, flooding or leaky pipes.

These issues can be resolved either by depositing money in escrow to be released to the seller once the repairs are completed, or crediting the buyer for the cost of the repairs. It is possible though that upon the attorney’s advice the buyer will postpone the closing until all the repairs are completed.

Want to eliminate all Lakeland a closing delays?

Eliminate all real estate closing delays by selling your house to a local real estate investor such as Lakeland Home Buyers. We’ll buy your house in just one day and close in as fast as 7 days without the need for an appraisal, loan approval, lengthy home inspections or final walk-through.

What’s more, we’ll buy your Lakeland house as-is no matter its condition. Even if it is fire damaged, water damaged has open code violations or has suffered termite, foundation or roofing problems. Sell your house to us and you’ll also eliminate the need to hire an agent, pay a hefty commission and put up with the uncertainty of finding a buyer.

Call Lakeland Home Buyers at 863-372-8937 to get a top-dollar cash offer today. Count on us to understand your needs, provide solutions to your problems and deliver exceptional service.

Prefer a more visual presentation? Check out the 9 Closing Delays That Prevent a Fast House Sale infographic below.